- #BEST INVOICING SOFTWARE FOR FREELANCERS HOW TO#

- #BEST INVOICING SOFTWARE FOR FREELANCERS MANUAL#

- #BEST INVOICING SOFTWARE FOR FREELANCERS FULL#

- #BEST INVOICING SOFTWARE FOR FREELANCERS FREE#

With invoice software, it’s possible to create and distribute automated invoice reminders for overdue invoices. Auto-reminders Gone are the days of having to sit by the telephone and hound your customers for payment.Online invoicing Once invoices are generated and distributed digitally to clients, it’s then possible to reconcile your books with your business bank statements in a bid to spot recordkeeping issues that could affect your end-of-year accounts.Secondly, it’s then easy to convert these estimates seamlessly into genuine invoices that are registered in the system with the date they are sent out to customers First and foremost, this will give clients an idea of what their actual bill will be.

#BEST INVOICING SOFTWARE FOR FREELANCERS FREE#

Free software It’s also possible to get your hands on free invoice software that may not have the functionality and intuitive user experience of more expensive platforms but is still designed to help businesses comply with their tax obligations.Frequent usage On the flip side, there are businesses that create and distribute hundreds of invoices daily that require rock-solid invoicing software, with ‘Pro’ subscription plans that offer high-volume client lists.That’s because the best invoicing software platforms offer no monthly subscription fees and free distribution of occasional invoices Infrequent usage Let’s say you are a small business or self-employed freelancer that only submits invoices once a month, there are cost-effective solutions for occasional invoicing.However, there are some invoicing software options that are better suited to certain business demographics:

#BEST INVOICING SOFTWARE FOR FREELANCERS MANUAL#

The most intuitive and best invoicing software platforms are a sound investment for your business, simply because they can help to automate a string of regular and irregular accountancy tasks that may have been traditionally handled via manual processes. Those new to choosing the best online invoice program may also wish to choose the best billing software that commits to 24/7 around-the-clock customer support, complete with manuals, tutorials and knowledge centers to help you hone your craft. Primarily, you will want an invoice program that is safe to use, and keeps all your business and customers' data secure. Just as you would with any other type of software for your business, you need to do your research into the best invoicing software options to select the right platform for your needs.

#BEST INVOICING SOFTWARE FOR FREELANCERS HOW TO#

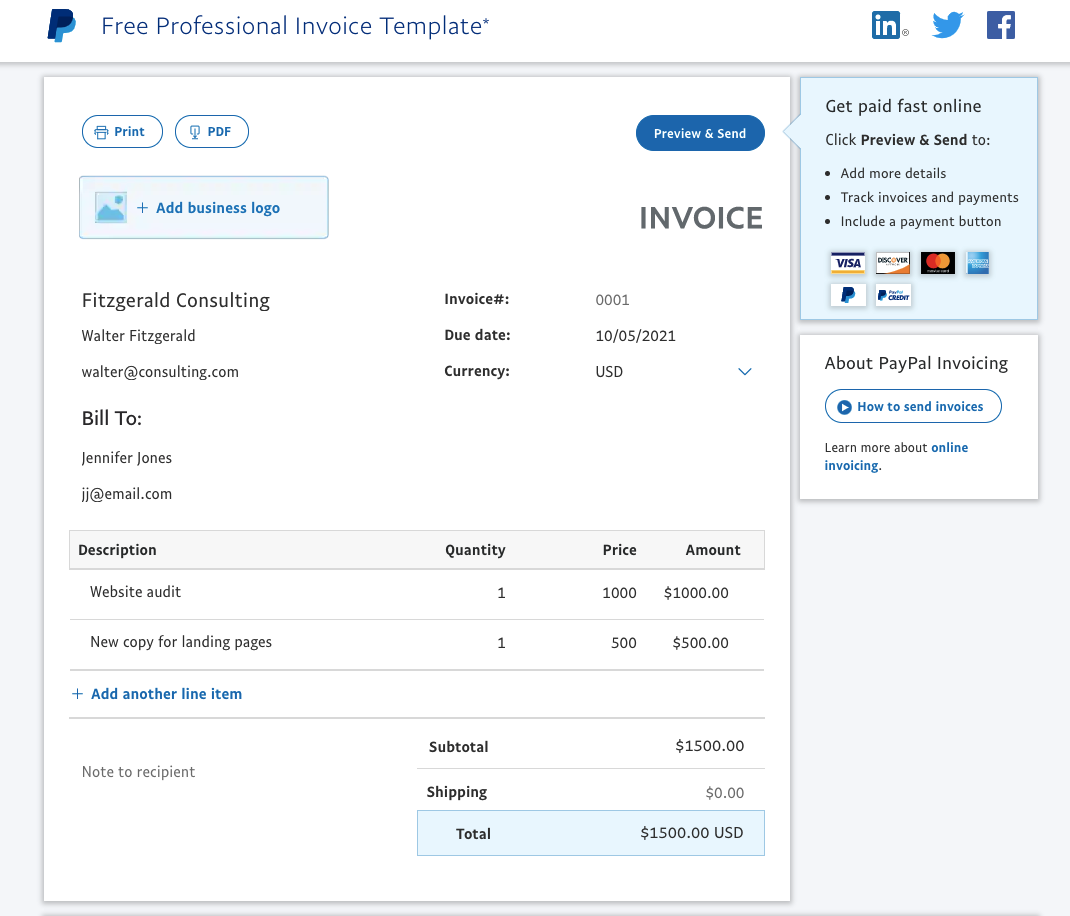

How to choose the best Invoicing Software Digital or cloud-based invoicing software allows businesses like yours to personalize all aspects of the invoicing process, creating your own invoice templates, populating all the data you need and importing generated invoices into an overarching accounts dashboard where you can keep track of paid and unpaid invoices. More recently, invoice management software has made accounting that much easier for small businesses without a dedicated in-house finance department to oversee accounts payable. That’s where the best invoicing software comes in.

#BEST INVOICING SOFTWARE FOR FREELANCERS FULL#

In the past, when cash payments were rife and bookkeeping was typically a manual process, businesses were all too often stung with unforeseen tax bills due to erroneous billing procedures that didn’t give a full – and correct – picture of their income. Whenever you sell goods or services as a business, your first port of call is to raise an invoice in order to receive payment from your customers. That’s because the best invoicing software and applications can automate some of this process and streamline your business finances. However, these methods are time-consuming and fraught with danger, with the potential for making human errors higher than it needs to be. You might have even used paper-based bookkeeping. Traditionally, businesses like yours may have used spreadsheets to monitor invoices raised and when the funds have been paid into your company account. Managing your business’ income and ensuring accountability for every cent earnt and every cent spent is important for many reasons not least to ensure that your business pays the tax it owes.

Getting the accounts of your business right from the get-go can set the tone for any start-up. How do companies handle their account work online?

0 kommentar(er)

0 kommentar(er)